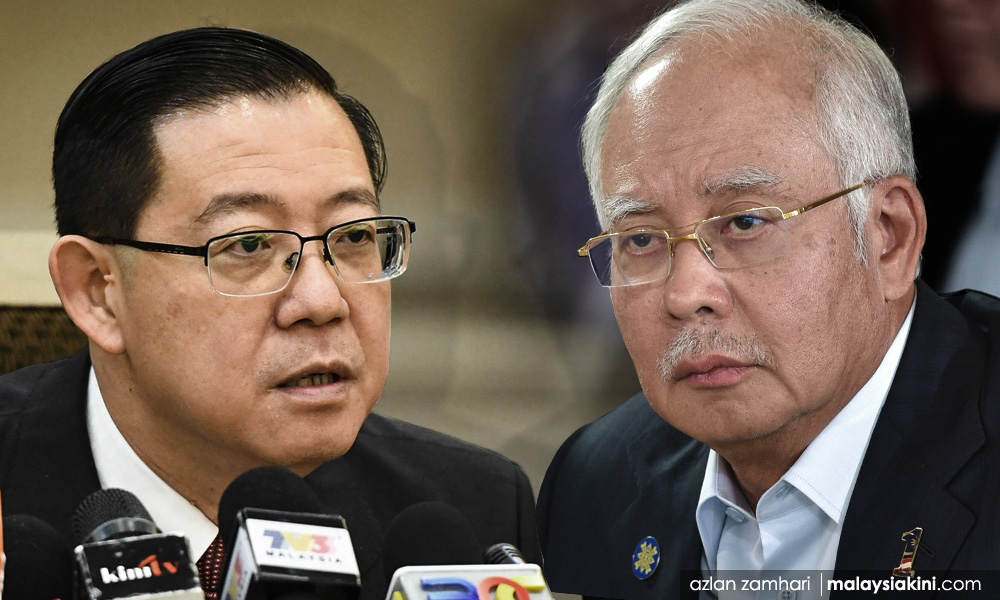

Finance Minister Lim Guan Eng wants former prime minister Najib Abdul Razak to explain where the US$8.33 billion in 1MDB funds are.

"Where has the US$1.83 billion invested with Petrosaudi International Limited between 2009 and 2011 gone to?

"Where has the US$3.5 billion raised in 2012 for the purposes of acquiring power plants in Malaysia gone to?

"Where has the US$3 billion raised in 2013 for the purposes of investing in TRX gone to?" Lim asked in a statement today.

He was firing back at Najib, who on Friday, dismissed Lim's revelation that the Finance Ministry had given 1MDB almost RM7 billion in bailouts.

The three issues mentioned by Lim were each in reference to a phase under which 1MDB funds were allegedly misappropriated.

The Petrosaudi International investment had allegedly been misappropriated by 1MDB-linked businessperson Jho Low under what the US Department of Justice dubbed the "Good Star phase".

Meanwhile, the power plant and TRX funds were allegedly misappropriated under the Aabar-BVI and Tanore phases.

Meanwhile, Lim also rubbished Najib's claims that the Finance Ministry was simply taking over 1MDB assets, and provided a detailed breakdown of his arguments.

The full statement is as follows:

Najib Abdul Razak must be held responsible and accountable for the 1MDB corruption scandal

I have written in a May 22, 2018 statement that the Ministry of Finance (MOF) has since April 2017 made payments on behalf of 1MDB amounting to RM6.98 billion.

The figure has yet to include another RM954 million payment that needs to be paid before the end of this year. All these payments tantamount to a major bailout of 1MDB.

Former prime minister Najib Abdul Razak wrote on his Facebook that it is “wrong to call it a bailout of 1MDB” on Friday evening.

Essentially, he argued that 1MDB had transferred all of its real estate assets including Tun Razak Exchange (TRX) and Bandar Malaysia to the MOF as recommended by the Public Accounts Committee (PAC).

Hence he claimed these payments should be rightly construed as "compensation" to 1MDB.

Najib could not be more wrong in making the presumption.

1. The transfer of these assets back to the MoF in April 2017 was NOT a “sale and purchase” transaction, nor should it be. MOF officials have confirmed that no such S&P agreement executed to the effect. This is consistent with PAC recommendation.

The PAC had found that 1MDB had neither the financial means, nor the ability to develop, or even to sell these parcels of land. Hence, the MOF needed to take over these projects in order to ensure their continued viability.

2. The former finance and prime minister must not forget that these parcels of land were originally sold by the government to 1MDB at bargain basement prices between 2010 and 2012.

a. The 70-acre TRX plot was sold to 1MDB for RM230 million, or approximately RM74 per square feet (psf).

b. The 486-acre Bandar Malaysia was sold to 1MDB for RM1.6 billion, or approximately RM72 psf.

Why should the MOF compensate 1MDB to the tune of tens of billions of ringgit as asserted by Najib, when 1MDB has hardly carried out any development on the land?

3. Let me also remind the former prime minister that the MOF did not take over these entities “for free”:

a. When MOF took over TRX City Sdn Bhd, it came attached with an RM800 million loan from SOCSO, which is due in 2020.

b. When MOF took over Bandar Malaysia Sdn Bhd, it came attached with an RM2.4 billion sukuk, to be repaid from 2021 to 2024.

It should also be noted that the auditor-general in his report on 1MDB had confirmed the above borrowings were not used for their intended purposes, that is, they were not used for the development of the above projects.

1MDB president Arul Kanda also confirmed this himself when he testified to the PAC.

Hence, if anything, MOF should be claiming compensation from 1MDB for also assuming these liabilities, not the other way around.

4. In addition, the MOF has already made additional payments to, or on behalf of 1MDB with regards to the above projects.

a. The MOF, via its wholly-owned subsidiary Aroma Teraju Sdn Bhd, had acquired 2.3 acres of land from TRX in September 2015 for the sum of RM250 million.

b. The MOF had refunded a deposit amounting to RM741 million on behalf of 1MDB to the consortium led by Iskandar Waterfront Holdings Sdn Bhd after the Bandar Malaysia sale and purchase agreement was

terminated in May 2017.

This was because 1MDB had used up the deposit for other purposes and did not have the money to refund the deposit.

c. On top of the above "contributions" made by the MOF, 1MDB had sold two additional parcels of TRX land to government-linked entities, making ludicrous profits in the process:

i. 1.57 acres of land sold to Lembaga Tabung Haji for RM188.5 million (RM2,750 psf) in April 2015

ii. 1.25 acres of land sold to Affin Bank, a subsidiary of Lembaga Tabung Angkatan Tentera (LTAT) for RM255 million (RM4,680 psf) in August 2015.

5. Finally and perhaps most importantly, the RM6.98 billion paid by MOF on behalf of 1MDB were in relation to borrowings completely unrelated to the above real estate projects. The payments were instead made for:

a. Servicing the coupon interest of RM5 billion 30-year bond issued in 2009. This was mainly used for 1MDB’s failed investment with PetroSaudi International Limited.

b. Servicing the coupon interest for US$3.5 billion worth of 10-year bonds issued in May and October 2012. These were intended for the acquisition of power plant assets. These assets have since been disposed and their proceeds have been completely utilised. However, the bonds remain outstanding in 1MDB.

c. Servicing the coupon interest for US$3 billion of 10-year bond issued in March 2013. The bond was intended to fund the development of TRX. However, the funds raised were never utilised to develop TRX,

as reported by the auditor-general.

d. Repaying in full the US$1.2 billion of advance from Abu Dhabi’s International Petroleum Investment Corporation (IPIC). The advance was taken in April 2015 to repay US$975 million of borrowings from a

Deutsche Bank-led consortium.

Therefore, why should any returns from the real estate projects – land which was originally acquired cheap from the government – be used to cover up the financial holes created by all of 1MDB’s other financial misadventures and shenanigans?

Hence, given all of the above facts and figures, there could be no other description for the RM6.98 billion worth of payments by MOF on behalf of 1MDB to date, other than to describe it as the single largest bailout in history carried out by the government of Malaysia.

Instead of debating whether the above payments were a bailout by the MOF, it would be more productive for Najib to account for the following transactions:

i. Where has the US$1.83 billion invested with Petrosaudi International Limited between 2009 and 2011 gone to?

ii. Where has the US$3.5 billion raised in 2012 for the purposes of acquiring power plants in Malaysia gone to?

iii. Where has the US$3 billion raised in 2013 for the purposes of investing in TRX gone to?

The MOF will work hand-in-glove with the 1MDB special committee set up by Prime Minister Dr Mahathir to uncover the complete truth behind the 1MDB in order to (i) recover as much of the lost and stolen funds as possible to plug the debts and deficits created by the Najib administration, and (ii) punish those responsible for the worst corruption scandal ever in Malaysian history. - Mkini

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.